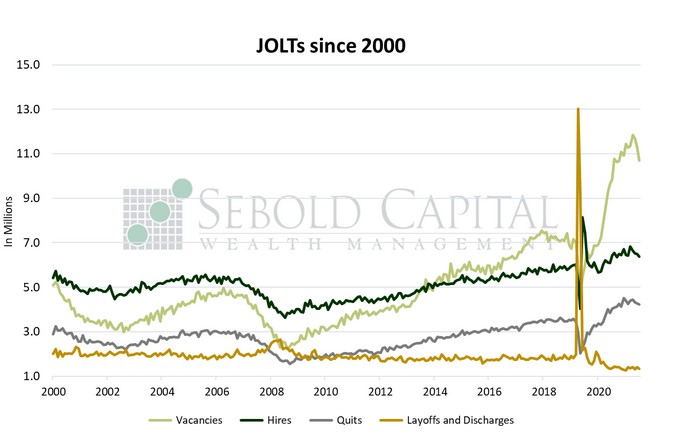

The JOLTs report is the Job Openings and Labor Turnover Survey, which tracks several trends in evaluating the labor market. Through JOLTs, we can see voluntary and involuntary separations from employment in addition to new job openings and hires that have taken place. While the report provides detailed information about the condition of the labor market, it is not considered to be very timely since the information is delayed by two months.

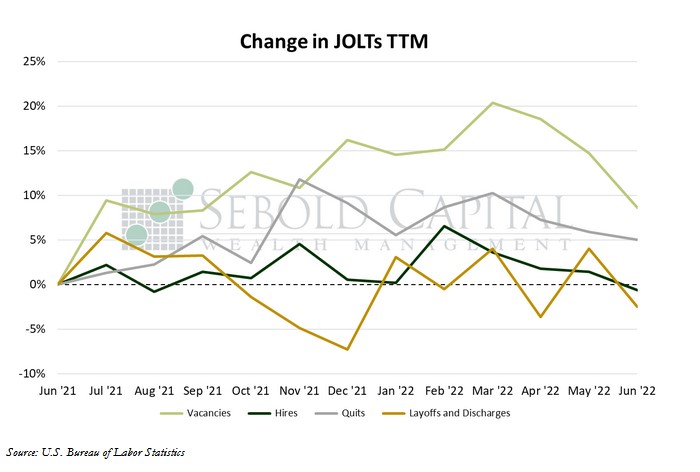

In June, vacancies declined by 5.4% to 10.7 million, while the number of hires fell by 2.0% to 6.4 million. Total separations also decreased, with 0.9% fewer people quitting their jobs compared to the previous month—a total of 4.2 million—and layoffs declining by 6.3% to 5.9 million. The changes in hires and separations yielded a net gain in employment of 443,000, the smallest since March.

Demand for workers fell to the lowest level since last September, with the number of job openings declining for the third consecutive month. Nevertheless, the number of jobs available continue to exceed the number of officially unemployed workers by quite a wide margin; there were 181 openings for every 100 unemployed individuals back in June. The data suggests a slowdown in the labor market, although there are no apparent reasons for concern just yet. Labor demand and hiring by firms continue to be historically high, and layoffs remain below pre-pandemic levels. The number of people leaving their jobs voluntarily has likewise been in decline for the past three months, indicating that workers are beginning to lose some of that confidence that has been partly responsible for the labor shortage and the meteoric increase in wages. The labor market is likely simply becoming less tight, which should help ease pressure on wages and by extension on prices.

That said, the JOLT survey is one of the less timely employment indicators out there. The data is two months old and a lot can change in that period of time—especially in an environment that has both high inflation and rising interest rates. More timely indicators, such as initial unemployment claims, have been showing what could potentially be the first signs of turmoil in the labor market. Private sector indicators, such as the Institute for Supply Chain Management’s services and manufacturing PMIs, go one step further and suggest that the labor market is experiencing a contraction; the employment sub-indexes for both PMIs are currently below 50, which is the key level for determining contractions or expansions. Keeping an eye on the labor market over the next few months will be crucial to determine whether an actual recession is in the cards or not.