The 10-Year Treasury Rate is the yield received for investing in a US government-issued bond that has a maturity of ten years. When the yield rises, it means that there is less demand for US Treasuries, and they are therefore trading at a lower price. Conversely, when the yield declines, it means that investors are buying more Treasuries and driving up the price as a result. This is usually the case when investors are looking for safer alternatives due to uncertain market conditions as US Treasuries are thought to be some of the safest assets out there, hence why the 10-Year rate is known as the “risk-free rate.”

The 10-Year Treasury Rate is the yield received for investing in a US government-issued bond that has a maturity of ten years. When the yield rises, it means that there is less demand for US Treasuries, and they are therefore trading at a lower price. Conversely, when the yield declines, it means that investors are buying more Treasuries and driving up the price as a result. This is usually the case when investors are looking for safer alternatives due to uncertain market conditions as US Treasuries are thought to be some of the safest assets out there, hence why the 10-Year rate is known as the “risk-free rate.”

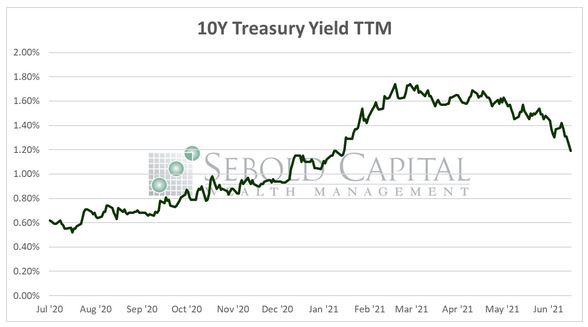

On Tuesday, Treasury yields slipped to their lowest level since February, with the 10-Year hovering around 1.20% and dropping as low as 1.13%—about 18 basis points below the previous day’s close. The spread between the 10-Year and 30-Year Treasuries currently sits at 0.62%, about 24 basis points below its 52-week high of 0.86% in February. When the spread between the 10 and 30-Year declines, it is indicative of a flattening yield curve and a flight to safety by investors.

Fears over the spread of Delta variant appear to have spooked investors as some believe it could derail the global economic recovery. On Monday, stocks had their worst day since October while Treasuries rallied. Some analysts have mentioned that there is even some chatter surrounding the possibility of 10-Year yield dropping below 1.0%, which would be indicative of a considerable uncertainty growing among investors. Yields declined to record low levels in early 2020, right as the pandemic was beginning to unfold and the high levels of uncertainty caused investors to flee to the safety of government paper. While it is unlikely that yields would return to those levels, it is entirely possible that they will continue to decline if the market remains concerned about this new Covid variant.

July 20, 2021