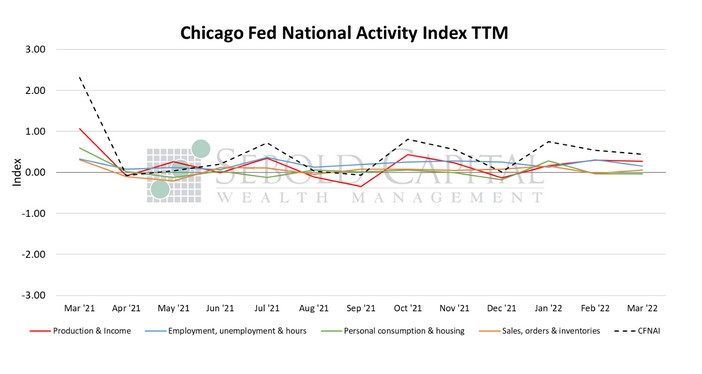

The Chicago Fed National Activity Index (CFNAI) is an indicator designed to gauge overall economic activity and related inflationary pressure. It is a weighted average of 85 existing monthly indicators of national economic activity that are divided into four broad categories of data: production & income; employment, unemployment, & hours; personal consumption & housing; and sales, orders, & inventories. The index is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend, and a negative index reading corresponds to growth below trend.

The Chicago Fed National Activity Index (CFNAI) is an indicator designed to gauge overall economic activity and related inflationary pressure. It is a weighted average of 85 existing monthly indicators of national economic activity that are divided into four broad categories of data: production & income; employment, unemployment, & hours; personal consumption & housing; and sales, orders, & inventories. The index is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend, and a negative index reading corresponds to growth below trend.

In March, the CFNAI declined by 0.10 points to an index level of 0.44. However, the index’s three-month moving average rose by 0.14 to a reading of 0.57. Two of the four broad indicators that make up the index declined last month. Production and income indications fell by 0.03 points to a level of 0.27, while the sub-index that measures employment conditions declined by 0.15 points to a reading of 0.16. Personal consumption and housing indicators remained unchanged for the month at a reading of -0.04. That said, conditions related to sales, orders, and inventories improved last month, with the sub-index advancing 0.09 points to a level of 0.06 and escaping negative territory.

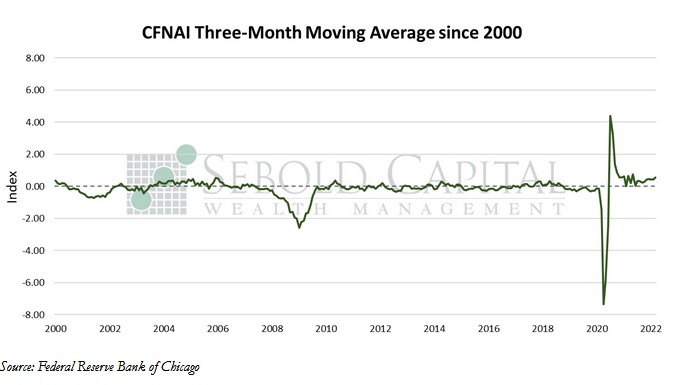

Economic activity continued to expand in March, although growth moderated compared with the previous month. At a time when murmurs about the possibility of a looming recession are getting increasingly louder, the latest CFNAI release paints an interesting picture. On the one hand, the index did decline last month, although it remains in positive territory, therefore implying that economic growth remains above trend. Furthermore, the index’s three-month moving average—which smooths out the potentially noisy monthly data—rose to a ten-month high in March. Now, this data is of course backwards-looking. It does not show what economic conditions will be like in a few months, or even what they look like today. But a recession reading for the CFNAI-MA3 would be a value below -0.7; there is certainly plenty of wiggle room there. That said, the economic landscape will certainly continue to shift over the next several months. Interest rates will rise, inflation will remain historically high (even if the Fed manages to rein in inflation, it will not happen overnight), and the Fed may even begin shrinking its balance sheet. The risk of a contraction will depend largely on the economy’s sensitivity to these factors, and that at the moment remains unlikely.

April 26, 2022