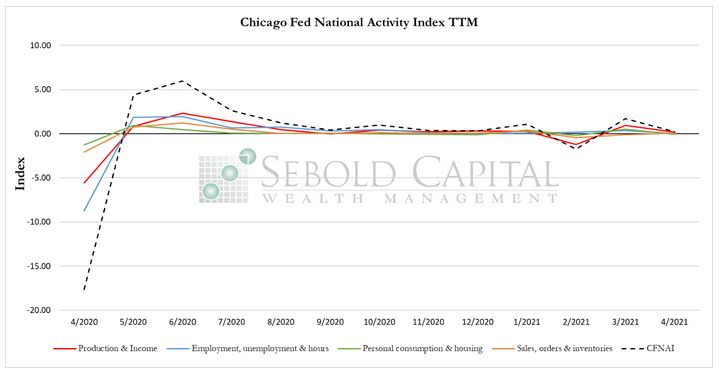

The Chicago Fed National Activity Index (CFNAI) is a weighted average of 85 existing monthly indicators of national economic activity that are divided into four broad categories of data: production & income; employment, unemployment, & hours; personal consumption & housing; and sales, orders, & inventories. It is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend, and a negative index reading corresponds to growth below trend.

The Chicago Fed National Activity Index (CFNAI) is a weighted average of 85 existing monthly indicators of national economic activity that are divided into four broad categories of data: production & income; employment, unemployment, & hours; personal consumption & housing; and sales, orders, & inventories. It is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend, and a negative index reading corresponds to growth below trend.

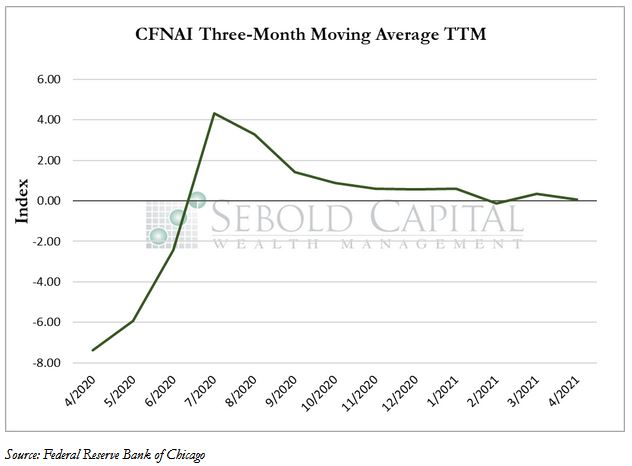

In April, the CFNAI fell by 1.47 points to a level of 0.24. The index’s three-month moving average decreased by 0.28 points to a reading 0.07. Three out of the four broad indicators that make up the index declined last month. Production and income indicators fell by 0.74 points to a level of 0.18. The sub-index measuring employment conditions declined by 0.33 points to a reading of 0.05. Personal consumption decreased by 0.56 points to a level of -0.06. Sales, orders, and inventories was the only category that improved in April, with the corresponding sub-index rising by 0.16 points to a reading of 0.07.

Last month, the CFNAI fell from its highest level since August 2020, suggesting a slowdown in economic growth. While the economy continues to expand, as signaled by the positive index reading, it has lost most of the momentum it had shown back in March. Personal consumption indicators declined in April to a negative reading, likely due to the effects of the latest round of stimulus checks wearing off. The sub-index that measures employment-related indicators barely remain in positive territory, highlighting the ongoing labor shortages reported by many businesses. The three-month moving average, which provides a more consistent picture of economic growth, continues to signal that the economy is in expansion territory since it remains above -0.70. However, the indicator also fell sharply from the previous month’s value, signaling that the economy is expanding at a slower pace.

May 24, 2021