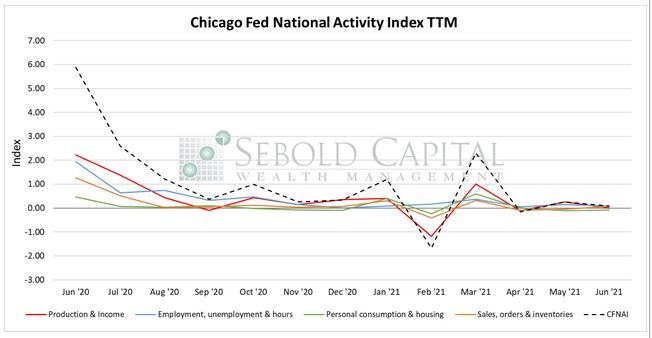

The Chicago Fed National Activity Index (CFNAI) is a weighted average of 85 existing monthly indicators of national economic activity that are divided into four broad categories of data: production & income; employment, unemployment, & hours; personal consumption & housing; and sales, orders, & inventories. It is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend, and a negative index reading corresponds to growth below trend.

The Chicago Fed National Activity Index (CFNAI) is a weighted average of 85 existing monthly indicators of national economic activity that are divided into four broad categories of data: production & income; employment, unemployment, & hours; personal consumption & housing; and sales, orders, & inventories. It is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend, and a negative index reading corresponds to growth below trend.

In June, the CFNAI declined by 0.17 points to an index level of 0.09. The index’s three-month moving average declined from 0.80 to a reading of 0.06. Two of the four broad indicators that make up the index declined last month. Production and income indicators fell by 0.25 points to a level of 0.01. The sub-index that measures employment declined by 0.06 points to a reading of 0.09. However, personal consumption indicators improved slightly, rising from -0.11 to -0.08. Likewise, sales, orders, and inventories rose by 0.10 points to a level of 0.06 after being in negative territory for two consecutive months.

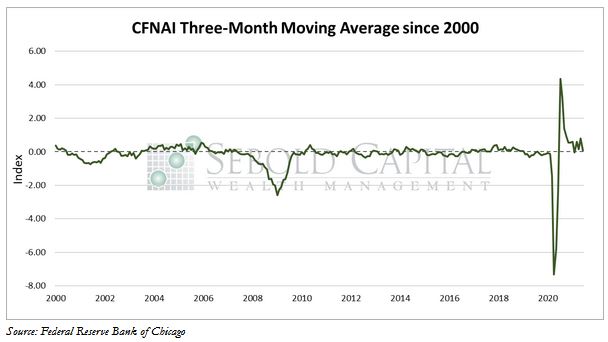

Last month, the CFNAI declined as economic activity in the U.S. lost momentum. The economy is now growing barely above historical trend, as shown by the index. The three-month moving average, however, indicates that the economy remains firmly in expansion territory, as the value remains above -0.70. The CFNAI diffusion index tells a similar story, as its current level of 0.13 remains above the -0.35 reading that has historically been associated with economic growth. The abnormally high rate of economic growth seen over the past few months has been largely a product of the pandemic-related restrictions being lifted and was likely not sustainable in the long run. Barring another lockdown or severe restrictions being reimposed, economic conditions should normalize and return to a growth rate that is consistent with historical trends.

July 26, 2021