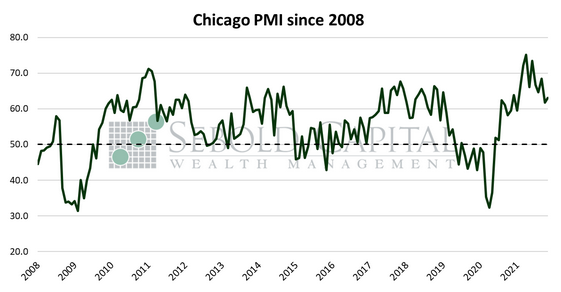

Chicago PMI is a composite index of business conditions in the Chicago area. Data from Chicagoland firms is collected by the financial news firm, Market News International, through manufacturing and non-manufacturing surveys sent to businesses. A drop in demand for goods is reflected in businesses’ responses in the Chicago PMI survey, which, is in turn, reflected in a lower index reading. Readings above 50 points indicate an expanding business environment, while readings below 50 indicate a contractionary environment.

Chicago PMI is a composite index of business conditions in the Chicago area. Data from Chicagoland firms is collected by the financial news firm, Market News International, through manufacturing and non-manufacturing surveys sent to businesses. A drop in demand for goods is reflected in businesses’ responses in the Chicago PMI survey, which, is in turn, reflected in a lower index reading. Readings above 50 points indicate an expanding business environment, while readings below 50 indicate a contractionary environment.

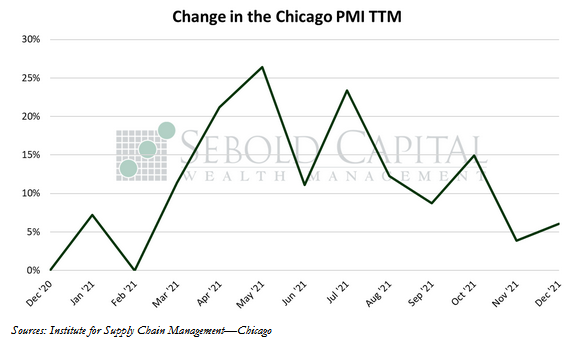

In December, the Chicago PMI rose by 1.3 points to an index level of 63.1. The figure came in slightly above market expectations of 62.0 after a sharp decline last month. Given that the index remains firmly above 50.0 points, economic conditions in the Chicago area continue to be considered expansionary.

Economic activity in the Chicago area picked up again in December after moderating slightly in November. However, the indicators that make up the report showed rather mixed results. Production increased to its highest reading since July and the number of new orders placed increased, largely recovering from November’s drop. Order backlogs also dropped to their lowest reading of the year. Inventories rose for the third consecutive month as firms stocked up in response to persistent supply chain disruptions. Supplier deliveries continue to be slow, with firms reporting port congestion and issues with trucking. Prices paid appeared to ease slightly during the month, but they remain well above historical trends. The employment index slipped back into contraction territory following its second consecutive decline; firms continue to report difficulties finding qualified workers to fill vacant positions. This month’s special survey question was regarding the biggest challenge to executing plans for the holiday season anticipated by firms. The most common answers were global shortages, logistics, and staff shortages.

December 30, 2021