Existing Home Sales provide the number of purchases made for homes, condominiums, and co-ops that have already been built, while New Home Sales represent the number of brand-new houses that were purchased or committed to being purchased over the course of a month. Both new and existing home sales give an indication of the demand for housing. When people purchase a home, they buy goods to fill their homes with, lifting other sectors simultaneously. New home sales are also more impactful to GDP than existing home sales since the entire sale value is included instead of only the real estate commission being included for an existing home during the sale. While home resales may not generate new construction jobs as housing starts do, they have a similar effect on consumer spending as people purchase items for their new home.

Existing Home Sales provide the number of purchases made for homes, condominiums, and co-ops that have already been built, while New Home Sales represent the number of brand-new houses that were purchased or committed to being purchased over the course of a month. Both new and existing home sales give an indication of the demand for housing. When people purchase a home, they buy goods to fill their homes with, lifting other sectors simultaneously. New home sales are also more impactful to GDP than existing home sales since the entire sale value is included instead of only the real estate commission being included for an existing home during the sale. While home resales may not generate new construction jobs as housing starts do, they have a similar effect on consumer spending as people purchase items for their new home.

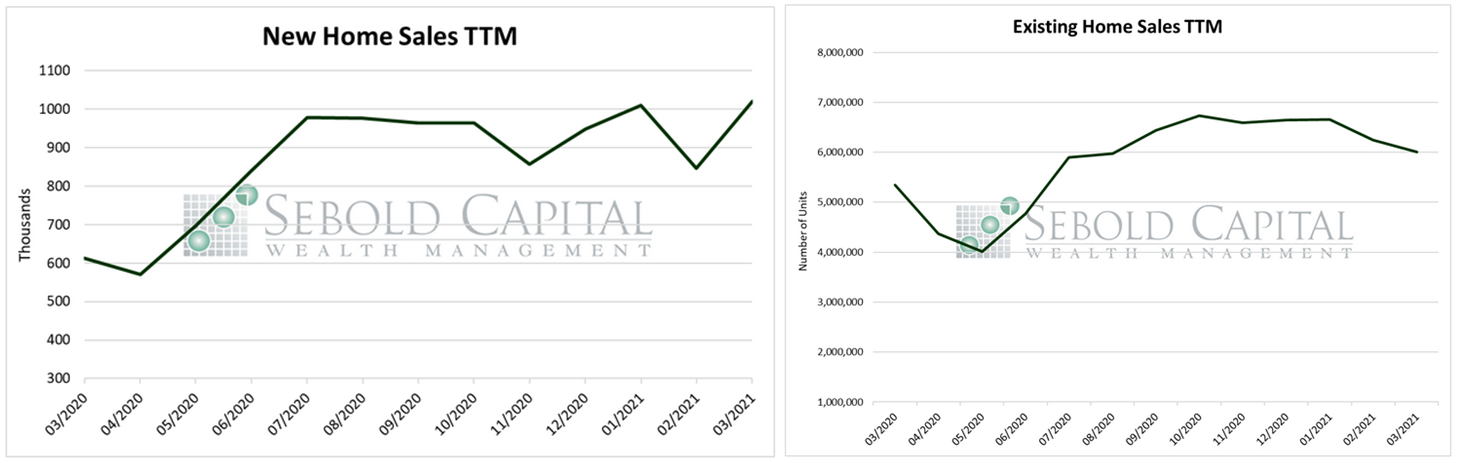

In March, sales of newly built homes surged by 20.7% to 1.02 million, while sales of existing homes declined by 3.7% to 6.01 million. Housing inventory grew slightly, increasing by 40,000 units to a total of 1.07 million. The mean sales price of an existing home increased by 3.83% to $355,000. The median sales price for a new house actually fell last month, decreasing by 4.4% to $330,000. Mortgage rates have started to rise, with the 30-year average currently sitting at 3.0%, up from 2.7% at the beginning of the year.

New home sales rose in three out of the four census regions last month. Sales of newly built homes surged by 40.2% in the south, 30.7% in the Midwest, and 20.0% in the Northeast, but plummeted by 30.0% in the West. Meanwhile, existing home sales declined slightly in all four census regions, falling by 3.7% in the South, 2.5% in the Midwest, 3.1% in the Northeast, and 8.2 % in the West.

Home sales showed mixed results last month as housing supply failed to meet consumer’s demand for homes. Home prices have surged 17.2% over the past year, partly as a result of this lack of supply. While housing inventory rose slightly in March, it remains at historically low levels as construction slowly picks back up. Both housing starts and building permits rose last month, suggesting that this supply and demand imbalance could be curtailed in the near future. Likewise, as mortgage rates inevitably continue to rise, demand will likely decrease allowing supply to catch up and prices to even out.

April 23, 2021