Having funds available for the pursuits of higher education commonly is a financial planning point of interest among our clientele. However, the rising amenities and increasing demand for college degrees in the workforce have driven higher institutions’ prices up. The average annual cost of attendance (all expenses) is $55,800 for a private college and $27,330 for an in-state public college¹. For many, balancing education funding and their own retirement planning is a delicate endeavor. There are many options to fund college expenses, but there is much less flexibility in retirement. Regardless, education funding can be a pain point in any financial plan. In 2018, less than 1/3 of parents were aware of 529 plans, and less than 18% have a 529 established for their children². 529 plans are the marquee tool to fund education expenses. This article will discuss the benefits of 529 plans and then illustrate the power of tax-sheltered compounding returns.

529s are the Best Option for Higher Education Planning

Tax-Sheltered Investment Growth

The main benefit of 529 plans is that the account can grow without taxation on investment growth or income. These funds can also be withdrawn tax-free if the funds are used for approved college expenses. Expenses include tuition, room and board, books, and other class fees. On top of this tax shelter, many states offer state tax deductions for contributions to 529 plans. Illinois offers a tax deduction of up to $10,000 in contributions ($20,000 for MFJ) each year. The total amount equates to about $500 in tax savings.

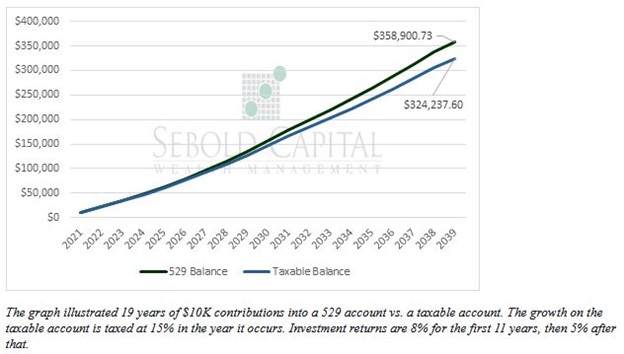

Tax-sheltered investment growth can be a powerful tool because college tuition has been outpacing inflation for years. Investing the funds in a tax-sheltered account provides additional growth opportunities. 529 plans have restricted investment options, but many states have adopted more flexible investments, and adequate investment allocations are achievable. The graph below illustrates nineteen years of sheltering investment growth.

Invest earlier to maximize the benefits of 529 plans

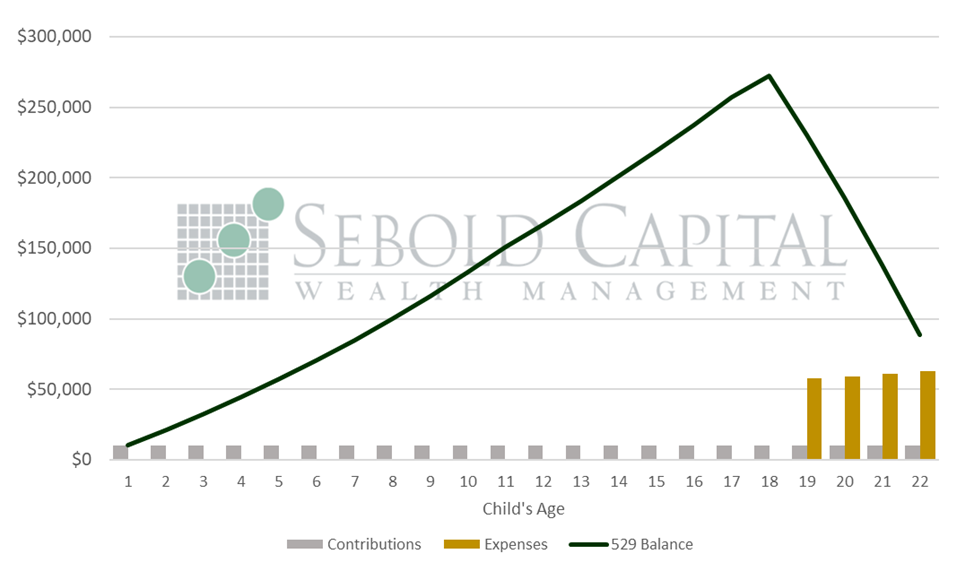

To maximize the value of 529s, the longer the time horizon, the better. Parents or grandparents can establish 529 plans for children as soon as they are born and have a social security number. The plan can be funded for parents and then transferred to a different beneficiary later. A prudent planner can open a 529 program before their child is born and then transfer the account to their name later – this allows for more than 18 years of compounding growth. The graph below illustrates a steady $10,000 529 contribution from age 0 to age 22. For this graph, college expenses are $55,800 a year (private school estimate), inflating at 3% every year. Total contributions equal $220,000 and cover $240,450 in education expenses.

Investment returns are 6% for the first 11 years, then 5% until age 18, and then 2% during the draw down phase.

Like most financial planning, the earlier the start, the easier the journey. There are penalties for taking 529 distributions that are not for qualified expenses, but excess funds in one 529 plan can be shifted to different family members. On top of this, if a child earns scholarship, the equivalent amount can be drawn penalty free.

Higher education is often an important financial planning objective for clients. Properly utilizing the tools available is the best way to tackle such a large expense. Please reach out to Sebold Capital Management if you would like to discuss college-funding strategies that are available and how they can fit into your larger financial picture.

https://research.collegeboard.org/trends/college-pricing

https://www.savingforcollege.com/article/number-of-children-with-529-plans