In early 2020, the Fed cut down their rate to zero to stimulate the economy. We have since learned this was far less effective to the overall market than planned, but individuals can still benefit significantly. An earlier post on charitable contributions discussed some new rules to increase donations for the tax year 2020. This article will dive further into attractive giving opportunities in a low-interest-rate environment. There are even opportunities to gift to family members or valued non-charitable causes.

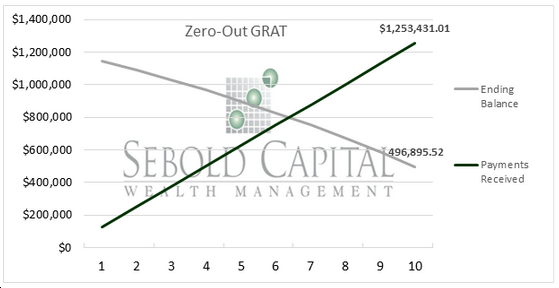

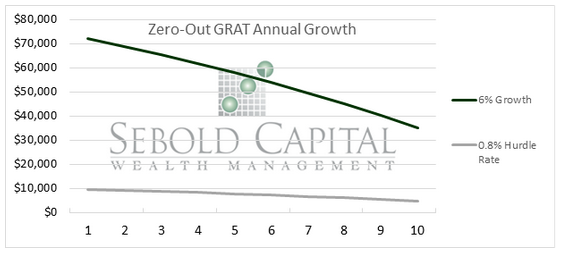

The first strategy is a Grantor Retained Annuity Trust (GRAT). A GRAT is an irrevocable trust funded by the grantor in exchange for a fixed dollar amount (annuity) over a specified term. In this example, we will assume zero-out GRATs. The valuable part about the GRAT is that the IRS expects assets will grow at the hurdle rate (Section 7520 Interest Rate) and any growth over that will pass to heirs free of gift and estate taxes. The hurdle rate for May 2020 is 0.8%. For example, a $1.2M 10-year zero-out GRAT is created and has six percent annual growth (5.2% over the established hurdle rate). The taxable value of the gift would zero, but the remaining amount passing to beneficiaries would be $496,895. See the illustration below.

On the charitable side, a Charitable Lead Annuity Trust (CLAT) is similar to the GRAT. A CLAT pays an annuity to a charitable organization, and non-charitable beneficiaries will receive the remainder. The CLAT also utilizes the IRS hurdle rate, and the excess growth will pass to heirs tax-free. To minimize gift tax, the CLAT should be designed to zero out as well. Grantors will receive a tax deduction equal to the present value of the annuity payments. In conjunction with lifting the 50% AGI limitation for charitable deductions, 2020 is a great year to implement a CLAT.

Both the GRAT and CLAT are great opportunities in a low-interest-rate environment. However, it is essential to note that the Grantor will be responsible for the tax on investment income during the trust’s term. There are consequences if a grantor passes with active GRATs or CLATs, so shorter trusts may be considered. There are plenty of benefits to gifting in 2020, but a donor needs to weigh all options. Please reach out to Sebold Capital Management if you would like to learn more about giving options in 2020.

** Disclosure: Sebold Capital Management does not provide legal or tax advice. Individuals should consult with their estate planning attorney and CPA before implementing a trust for tax purposes. IRA section 7520 interest rates will vary by month.