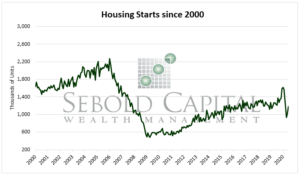

Housing starts track the number of new residential construction projects over a month. This indicator has implications for demand in construction spending/jobs, consumer wages, and complementary sectors such as durable household item sales. Along with building permits, housing starts is considered a leading economic indicator.

Housing starts track the number of new residential construction projects over a month. This indicator has implications for demand in construction spending/jobs, consumer wages, and complementary sectors such as durable household item sales. Along with building permits, housing starts is considered a leading economic indicator.

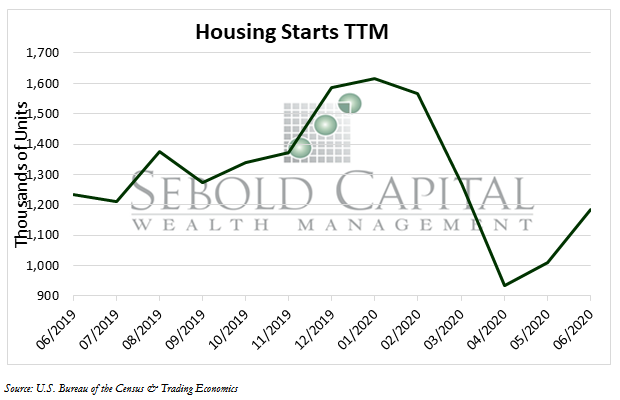

Housing starts rose to 1.18 million in June 2020, indicating that the number of new residential projects in the US increased by nearly 170,000 from May’s statistic of 1.01 million. This is a monthly increase of 17.3% and marks the return of a housing market consistent with low mortgage rates and built-up demand from a deferred spring home-buying season. Overall housing starts are down 3.97% from June 2019, but the index is continuing to improve and has rebounded exceptionally after reaching its lowest point in five years.

As a leading economic indicator in the US, housing starts increased significantly this past month providing evidence that the economy is strengthening once again. Additionally, building permits are up 2.1% this month and housing completions were up 4.3%. Home builders are now in a position to respond to new buyer preferences, especially due to the shrinking inventory of existing homes and rising inventory of new housing completions. With extremely low mortgage rates being offered to buyers, they are returning in numbers as the housing market continues to recover. The one concern that could pose a threat to a full recovery of the housing starts index is the rising cost of lumber, labor, and construction materials. These costs have the potential to push new home prices higher and out of reach for first-time buyers and thus could negatively impact the housing market. Overall, housing starts in the Northeast and Midwest experienced 114% and 29.3% increases in June and this can be attributed to home builder’s focus on creating houses with more space, better remote options, and less dense neighborhoods. With overall living preferences beginning to change based on the pandemic that is occurring, it is projected that housing starts will continue to rise over the next month and demand will hold steady. The housing market has proved to be one of the more resilient sectors of the economy during this economic downturn and 3rd quarter numbers of this year should exemplify this increase in stimulation in the housing market.

July 20, 2020