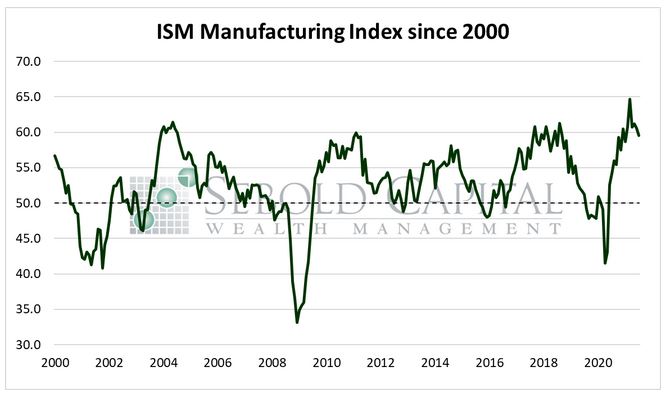

The Manufacturing PMI (formerly the ISM Manufacturing Index) is derived from a survey of purchasing managers and their outlook on overall conditions by looking at factors such as orders for durable goods, industrial production, and hiring. It gives a general direction rather than the specific strength of the factory sector and manufacturing activity in the U.S. A reading above 50 is an indicator that the manufacturing sector is growing while a reading below 50 indicates a contraction.

The Manufacturing PMI (formerly the ISM Manufacturing Index) is derived from a survey of purchasing managers and their outlook on overall conditions by looking at factors such as orders for durable goods, industrial production, and hiring. It gives a general direction rather than the specific strength of the factory sector and manufacturing activity in the U.S. A reading above 50 is an indicator that the manufacturing sector is growing while a reading below 50 indicates a contraction.

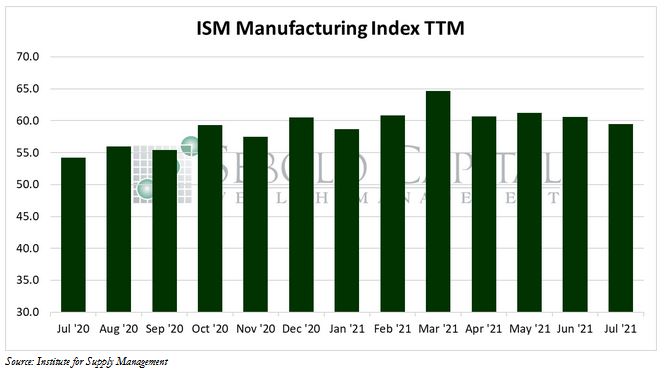

In July, the Manufacturing PMI declined by 1.1 percentage points to a level of 59.5, the lowest since January. However, this marks the fourteenth consecutive month of expansion for the manufacturing industry and for the overall economy as the index remains above 50 points. All six major manufacturing industries included in the survey reported moderate to strong growth last month, and seventeen out of the eighteen total industries that make up the report registered growth over the same period.

The Manufacturing Index is comprised of several equally weighted subindexes that measure conditions in the industry. Demand continues to expand, although at a slower rate, as three out of the four sub-indices that measure it declined last month. The only category sub-index that rose was Backlog of Orders, which highlights a trend that has been present for the past few months; firms and suppliers are struggling to meet increasing demand levels. Employment conditions improved for the first time since March, with the corresponding sub-index rising 3.0 points after briefly slipping into contraction territory. While respondents continue to report difficulties attracting and retaining workers, those challenges should begin to ease now that half the states have ended the expanded unemployment benefits and will likely continue to do so once they expire at a nationwide level in September.

Prices continued to rise in July, although seemingly at a marginally slower pace. The prices sub-index declined 6.4 points to a level of 85.7, although it remains considerably above historical levels. Prices for the manufacturing industry are still on track to rise by 19% in 2021 if the past seven months of the index are annualized. Overall, respondents remain optimistic about business levels in the manufacturing industry, although shortages of labor and raw materials, rising costs, and logistics challenges remain a concern.

August 2, 2021