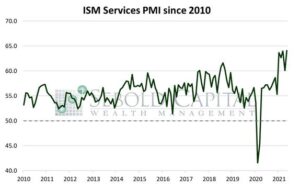

The ISM Services Purchasing Managers Index (PMI) helps determine the overall economic strength of the services sector. Components evaluated are employment, business activity, new orders, and supplier deliveries, which are then compiled into an index. The services sector represents a much larger share of the overall U.S. economy when compared to the manufacturing sector, making up approximately 80% of it; the sector’s economic weight makes it an important sign of growth, stagnation, or contraction. Readings above 50.0 indicate expansion while readings below 50.0 signal decline.

The ISM Services Purchasing Managers Index (PMI) helps determine the overall economic strength of the services sector. Components evaluated are employment, business activity, new orders, and supplier deliveries, which are then compiled into an index. The services sector represents a much larger share of the overall U.S. economy when compared to the manufacturing sector, making up approximately 80% of it; the sector’s economic weight makes it an important sign of growth, stagnation, or contraction. Readings above 50.0 indicate expansion while readings below 50.0 signal decline.

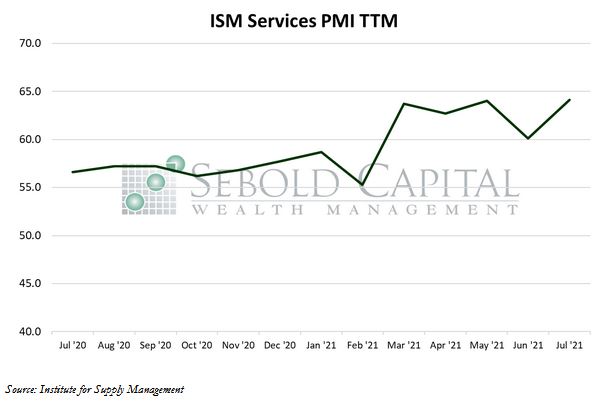

In July, the Services PMI rose by 4.0 to a level of 64.1, coming in well above market expectations of 60.1 and hitting another all-time high. This marks the fourteenth consecutive month of growth for the services sector and for the overall economy. Seventeen out of the eighteen industries that make up the index reported growth, and no industry reported a contraction.

The index is composed of ten different sub-indexes that measure different aspects of the services sector. All but three of these sub-indexes rose in July, with only inventories, order backlogs, and imports declining. Demand appears to be strong, with new export orders surging by 15.1 points to a level of 65.8 and new orders overall rising 1.6 points to 63.7. Business activity and production increased by 6.6 points to a reading of 67, and employment rose by 4.5 points to 53.8 after briefly slipping into contraction territory in June. However, prices remain a concern for firms and have risen at an alarming rate over the past few months. The index that measures prices rose 2.8 points, about 3.5%, to 82.3—the second highest level in the series’ history and the highest since 2005. Year-to-date, prices paid by firms in the services sector have soared 28.2%, and if the index is annualized, they are on track to surge 53.1% in 2021.

Overall, the services sector expanded at a rate that is considerably above its historical average in July. Pent-up demand continued to be released, although firms are still finding it difficult to meet said demand as they face labor shortages, supply chain challenges, and soaring prices. Raw material shortages should begin to clear up the coming months, however, high prices are likely to linger as firms are being forced to pay above-market wages in order to attract workers—which puts further pressure on prices.

August 4, 2021