The Manufacturing PMI (formerly the ISM Manufacturing Index) is derived from a survey of purchasing managers and their outlook on overall conditions by looking at factors such as orders for durable goods, industrial production, and hiring. It gives a general direction rather than the specific strength of the factory sector and manufacturing activity in the U.S. A reading above 50 is an indicator that the manufacturing sector is growing while a reading below 50 indicates a contraction.

The Manufacturing PMI (formerly the ISM Manufacturing Index) is derived from a survey of purchasing managers and their outlook on overall conditions by looking at factors such as orders for durable goods, industrial production, and hiring. It gives a general direction rather than the specific strength of the factory sector and manufacturing activity in the U.S. A reading above 50 is an indicator that the manufacturing sector is growing while a reading below 50 indicates a contraction.

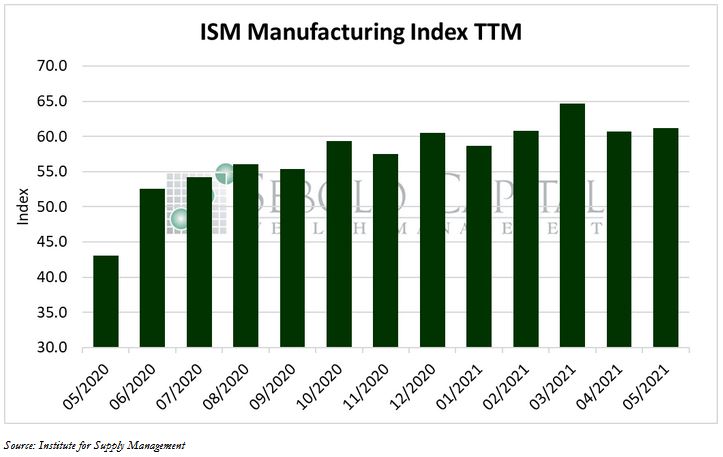

In May, the Manufacturing PMI rose by 0.5 percentage points to a reading of 61.2. This marks one full year of consecutive expansion for the manufacturing sector and the economy as a whole. All of the six major industries that make up the report registered moderate to strong growth last month, and sixteen out of the eighteen total industries included in the survey reported growth—the main exception being printing and related support activities.

The Manufacturing Index is comprised of several equally weighted subindexes that measure conditions in the industry. Demand, which is measured by the New Orders, New Export Orders, Customers’ Inventories, and Backlog of Orders subindexes, expanded last month as orders climbed and inventories hit another record low. However, consumption slowed down last month, with the production and employment subindexes posting a combined 8.2-point decrease. Employment continues to be a challenge for the manufacturing industry; the corresponding subindex barely remains in expansion territory, reflecting the ongoing labor shortages that continue to plague the economy. Input-driven constraints also continue to be a burden on the manufacturing industry, mostly manifesting as slow deliveries and high prices. The subindex that measures prices declined slightly in May, but continues to be quite elevated at 88.0 due to the inflationary pressures that are still present in the economy and that are impacting commodities the hardest.

Despite all the setbacks, the manufacturing industry continues to expand at an above-average rate. Low inventories suggest that demand will keep rising, at least in the near-term. Once the expanded unemployment benefits expire in September, the labor shortages should ease which will allow production to pick up slightly, although input-driven constraints will likely remain until the policies that have inflated the money supply—and therefore created the current surplus of money—are changed.

June 1, 2021