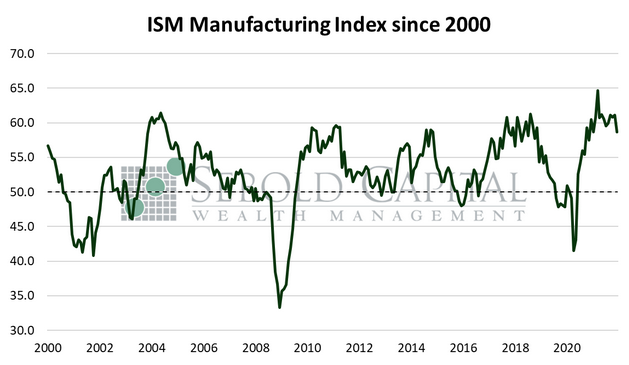

The Manufacturing PMI (formerly the ISM Manufacturing Index) is derived from a survey of purchasing managers and their outlook on overall conditions by looking at factors such as orders for durable goods, industrial production, and hiring. It gives a general direction rather than the specific strength of the factory sector and manufacturing activity in the U.S. A reading above 50 is an indicator that the manufacturing sector is growing while a reading below 50 indicates a contraction.

The Manufacturing PMI (formerly the ISM Manufacturing Index) is derived from a survey of purchasing managers and their outlook on overall conditions by looking at factors such as orders for durable goods, industrial production, and hiring. It gives a general direction rather than the specific strength of the factory sector and manufacturing activity in the U.S. A reading above 50 is an indicator that the manufacturing sector is growing while a reading below 50 indicates a contraction.

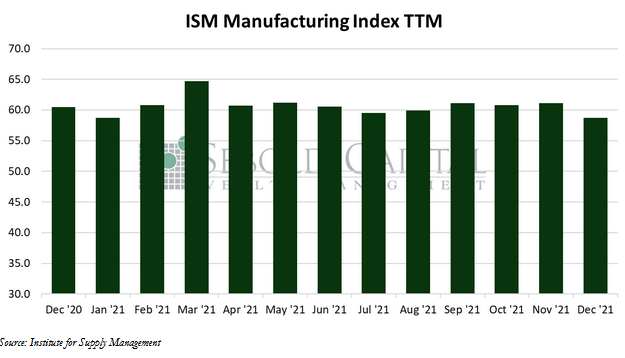

In December, the Manufacturing PMI declined by 2.4 percentage points to a level of 58.7—the lowest since January 2021. The reading came in below market expectations, which hovered around 60.2. Despite the decline, this marks the nineteenth consecutive month of growth for the manufacturing industry and for the economy as a whole since the index remains above 50 points. All six major manufacturing industries registered moderate to strong growth last month, and of the eighteen individual industries that make up the report, only three reported a contraction—wood products, printing, and paper products.

The Manufacturing Index is comprised of several equally weighted sub-indices that measure conditions in the industry. The manufacturing sector continues to see strong demand but faces seemingly relentless supply-chain constraints. Shortages of input materials, rising commodity prices, logistics challenges remain a challenge for firms. However, there seem to be some indications of improvements in labor availability and supplier delivery performance. Demand expanded in December, as shown by increases in the New Orders and New Export Orders indexes, as well as low customers’ inventories. The employment index saw its fourth consecutive monthly increase, indicating that firms’ ability to hire may be improving. The Supplier Deliveries, Inventories, and Imports indexes shows that inputs continue to constrain an expansion in production. On a more positive note, there are some signs of improving delivery times, which would certainly aid the ongoing shortages. The index that measures prices paid by the manufacturing industry declined last month, meaning that prices continued to rise but a slightly slower pace. That said, prices have been increasing for the past nineteen months, so drawing any conclusions from last month’s decline in the prices paid index would be a bit premature.

January 4, 2022