The Producer Price Index (PPI) looks at the average change in selling prices from the viewpoint of domestic producers of both goods and services. Three areas of production are observed: industry-based, commodity-based, and commodity-based final demand-intermediate demand. Investors look to the producer price index, which is a more relevant way of gauging inflation than the CPI because of the large basket of producers (100,000 price points) that Bureau of Labor Statistics uses as a data pool for their calculations.

The Producer Price Index (PPI) looks at the average change in selling prices from the viewpoint of domestic producers of both goods and services. Three areas of production are observed: industry-based, commodity-based, and commodity-based final demand-intermediate demand. Investors look to the producer price index, which is a more relevant way of gauging inflation than the CPI because of the large basket of producers (100,000 price points) that Bureau of Labor Statistics uses as a data pool for their calculations.

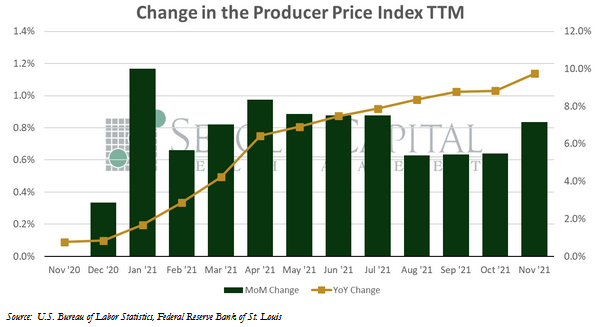

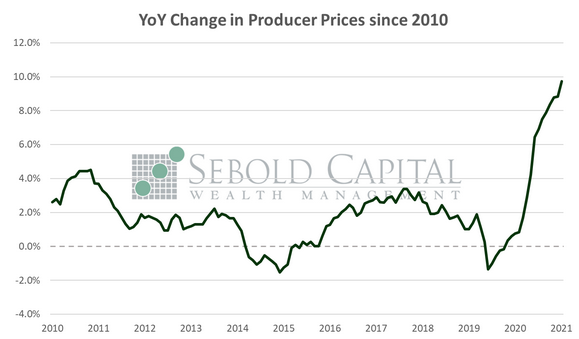

In November, the PPI rose by 0.8% to a level of 131.0, beating market expectations of a 0.5% increase. Core PPI, which excludes prices for food and energy (and is therefore considered to be less volatile), increased by 0.7% to a level of 128.9. Year-over-year producer inflation surged to 9.7%, while core producer prices have increased by 7.8%.

Prices paid by producers rose once again at a record pace last month, continuing the ongoing trend. The cost of goods increased 1.2% last month, while prices for services advanced by 0.7%. The latter is particularly noteworthy because prices for the services sector increased by a mere 0.2% in October. The faster increase last month may signal that the cost of services may be catching up after initially lagging once the economy reopened, meaning double-digit PPI inflation is likely in the horizon. Food and beverage prices increased by 1.2%, while energy costs advanced 2.6% despite lower crude oil prices. Commodity prices rose by 1.4% last month, while soaring by 22.8% on the year. The most notable gainers among commodities were iron and steel scrap, with prices increasing by 10.7% from the previous month.

December 14, 2021