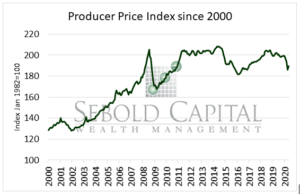

The Producer Price Index (PPI) looks at the average change in selling prices from the viewpoint of domestic producers of both goods and services. Three areas of production are observed: industry-based, commodity-based, and commodity-based final demand-intermediate demand. Investors look to the producer price index, which is a more relevant way of gauging inflation than CPI because of the large basket of producers (100,000 price points) that Bureau of Labor Statistics uses as a data pool for their calculations.

The Producer Price Index (PPI) looks at the average change in selling prices from the viewpoint of domestic producers of both goods and services. Three areas of production are observed: industry-based, commodity-based, and commodity-based final demand-intermediate demand. Investors look to the producer price index, which is a more relevant way of gauging inflation than CPI because of the large basket of producers (100,000 price points) that Bureau of Labor Statistics uses as a data pool for their calculations.

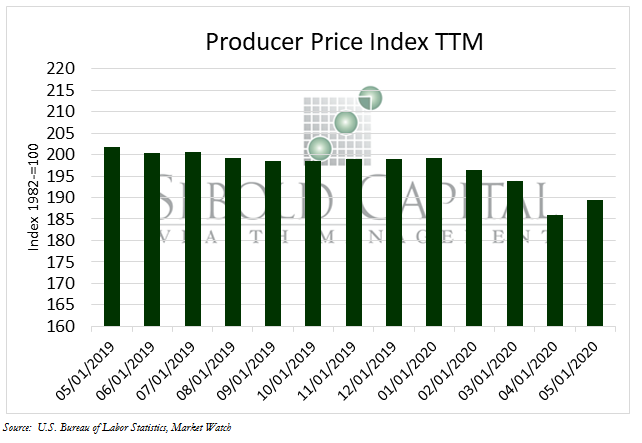

In the month of May, PPI increased by 3.4 points, rising to a level of 189.4. This marks a 1.83% increase from April’s index level of 186.0 but is 6.10% lower than the index level from May of 2019.

This month prices for final demand goods rose by 1.6% while the final demand services dropped by 0.2%.

This month’s increase in PPI is largely attributed to the elimination of the stay at home order across the United States. With shops and stores now open and operating at normal levels, demand for final goods will continue to increase and thus the economy should witness a gradual increase in personal spending over the coming months. Prices of goods and services related to food, energy, transportation, and entertainment & recreation are also expected to rise over the coming months as spending increases and the economy makes a slow and steady recovery. The oil market is one area that has already experienced an increase in price as it reacts to recovering demand. This might be short-lived, however, as evidence points to a possible second wave of Coronavirus cases. It is very unpredictable what will happen regarding this pandemic over the coming months, but the current PPI is a strong indicator that the worst has passed, and the economy is well on its way to recovery.

June 11, 2020