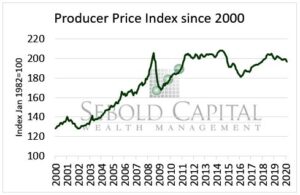

The Producer Price Index (PPI) looks at the average change in selling prices from the viewpoint of domestic producers of both goods and services. Three areas of production are observed: industry-based, commodity-based and commodity-based final demand-intermediate demand. Investors look to the producer price index, which is a more relevant way of gauging inflation than CPI because of the large basket of producers (100,000 price points) that Bureau of Labor Statistics uses as a data pool for their calculations.

The Producer Price Index (PPI) looks at the average change in selling prices from the viewpoint of domestic producers of both goods and services. Three areas of production are observed: industry-based, commodity-based and commodity-based final demand-intermediate demand. Investors look to the producer price index, which is a more relevant way of gauging inflation than CPI because of the large basket of producers (100,000 price points) that Bureau of Labor Statistics uses as a data pool for their calculations.

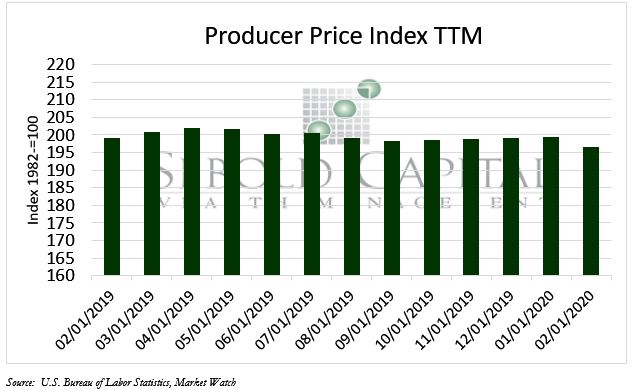

In February 2020, PPI decreased by -1.45% from January’s 199.4 to 196.5, a -1.4% decrease from one year ago. This is the biggest price drop within the past five years. Core PPI, which excludes volatile categories like food and energy, is up only 1.1% from last year.

The sharp monthly PPI decrease can be largely attributed to a drop in the cost of goods such as gasoline and services including, transportation and entertainment. Gasoline fell by 6.5%, and jet fuel 16.5%. This is a result of the Coronavirus, which is suppressing demand for recreational and travel-related services. Also, as a result of dropping demand, an oil price war was sparked between Russia and Saudi Arabia, which have forced oil prices down as they increase supply to make up for previously lost revenue. These factors combined have sparked fear of recession, and with the lack of demand for some services, prices will likely continue to decline, depending on how these two major events progress.

March 13, 2020