A Single Premium Immediate Annuity (SPIA) is an exchange of a lump sum (premium) for a stream of income (annuity) until the covered person dies. An SPIA may be beneficial to a financial situation, but there are several pros and cons to consider. First, an illustration of how an SPIA works and its value. Next, a discussion of the pros and cons. Finally, this article will touch on some critical riders to consider.

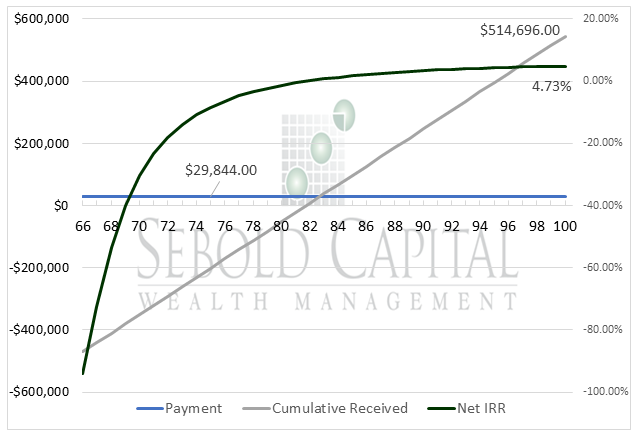

A Single Premium Immediate Annuity will often pay out a higher rate than the typical 4% recommended withdrawal rate from an investment portfolio. However, when the covered person dies, the amount paid is often forfeited to the underwriting company. The insurance company would take the remaining funds and cover their other annuity liabilities. Below is an illustration of a $500K SPIA for a 65-year-old male in Illinois (with no COLA). The internal rate of return (IRR) is the equivalent growth of the $500K investment over time.

The annuity stream breaks out into $29,844 a year. However, the net IRR does not reach 0% (the breakeven point) until 17 years into the contract. At age 99, the net IRR is still below a 5% equivalent return. An annuitant that dies before age 82 lost money, and if their expected return is 5%, they will lose out on performance if they die before age 100.

However, there are some specific situations where a single premium immediate annuity can be beneficial to a financial plan. The primary benefit is guaranteed income, meaning that the investment risk has shifted from the annuitant to the annuity company. Regardless of what the market does, the annuitant will receive the set amount stated in the contract. With guaranteed income, budget planning becomes more manageable in future years. There are also several riders available to address some of the chief concerns behind an annuity.

The biggest drawback of an annuity is that they are irrevocable contracts. The liquidity is gone and cannot be drawn against in case of an emergency. The premium used also reduces assets for heirs. Another drawback is the potential loss of purchasing power. If an annuity does not have a Cost of Living Adjustment Rider, the value of the annuity stream will decrease over time. If there is a COLA rider, your initial annuity stream will be lower, and typically spending is higher in these years. Finally, annuities aren’t always fully guaranteed; if the company fails, the state guaranty association will reimburse losses, but they may limit coverage to $300,000 depending on the state.

There are several annuity options and riders available to address some concerns. For example, there are single life with 10-year or 20-year certain, which guarantee payments for that period even if the annuitant dies. There may also be a cash refund, which ensures that beneficiaries will receive a lump-sum amount of the initial investment minus income payments made. These income options raise the floor of the return, but they also take away on the payment stream and lower the ceiling.

In conclusion, there is a lot to consider before starting an SPIA. An annuity can help increase monthly income over a 4% withdrawal rate and still guarantee future streams. Net Internal rate of return is a crucial factor, as it often takes a long period for an annuity to match a diversified portfolio or even breakeven on the initial investment. Discuss your situation with a financial professional to see if an annuity is right for you.

May 28, 2020

* Income annuity stream estimate taken from Charles Schwab Income Annuity Estimator. Income streams from annuities consider age, gender, residency, and can vary from provider to provider.