At its most recent policy meeting, the FOMC delivered its second interest rate hike for the year and the ninth …

M2 Money Stocks

M2 Money Stock refers to the measure of money supply that includes financial assets held mainly by households such as …

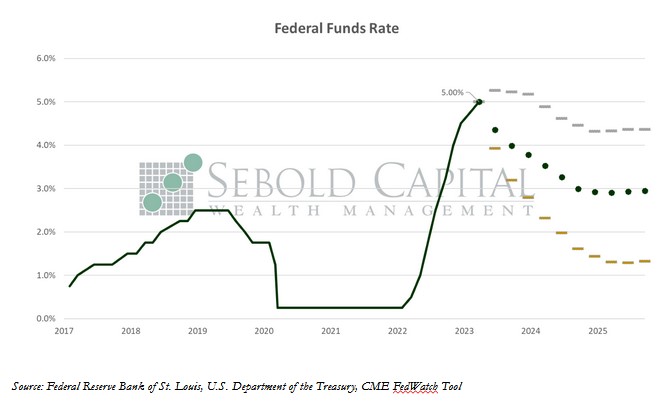

Federal Funds Rate

The Effective Federal Funds Rate is the interest rate at which banks trade federal funds with each other. This rate …

Are Businesses the New Banks?

More than half of all cash on the books at corporations is invested in investment grade corporate bonds. The record …

Cars Are Gold

A shoebox in your closet is usually a pretty safe place to keep your money, unless there is a fire …

How Legislation Killed the Community Bank

The total number of banking companies in the United States has significantly decreased in the past couple decades. At the …

2015 Big Mac Index

The Economist has updated their “Big Mac Index”. The index is a creative way of showing vales of goods and …