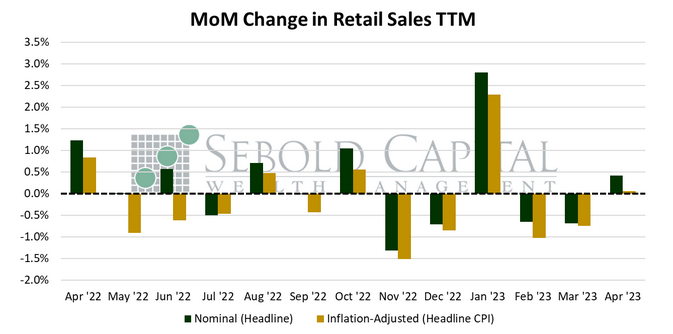

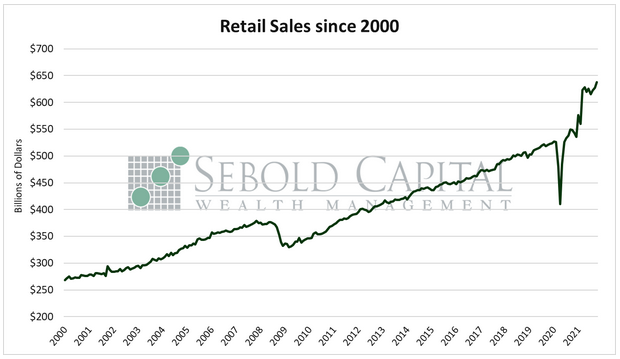

Retail Sales are the total amount of merchandise and related services sold to consumers. It is considered a sign of strength …

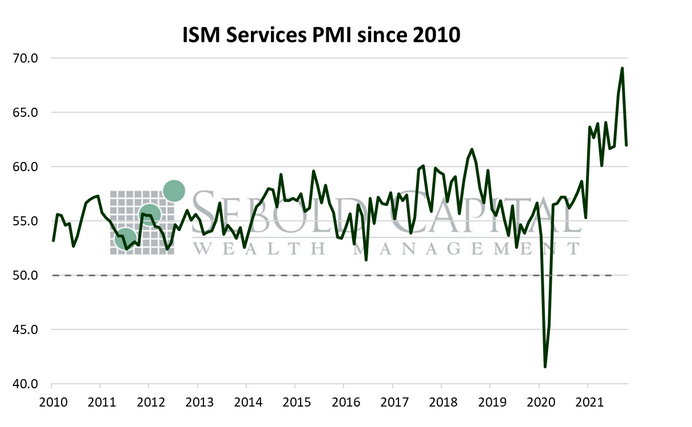

ISM Services Purchasing Managers Index

The ISM Services Purchasing Managers Index (PMI) helps determine the overall economic strength of the services sector. Components evaluated are …

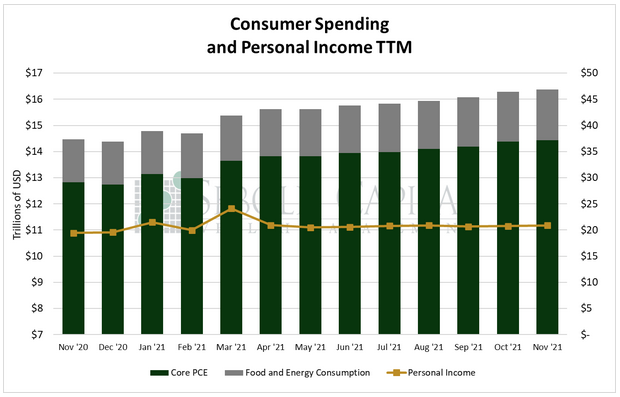

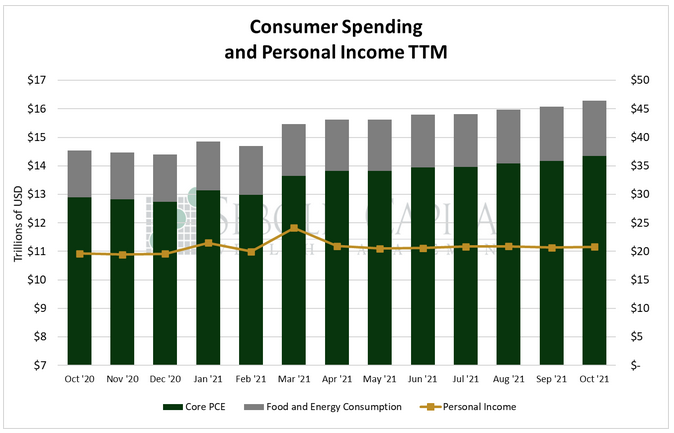

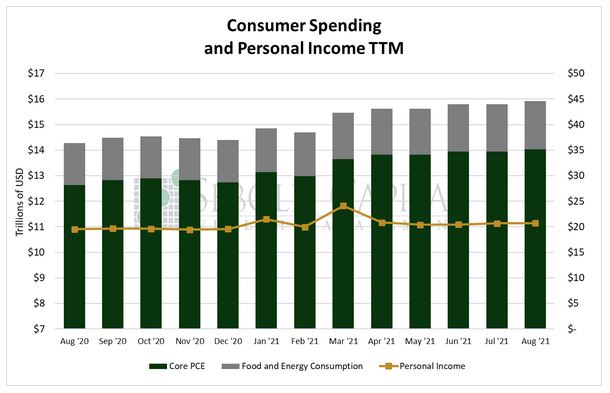

Consumer Spending

Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure …

Retail Sales

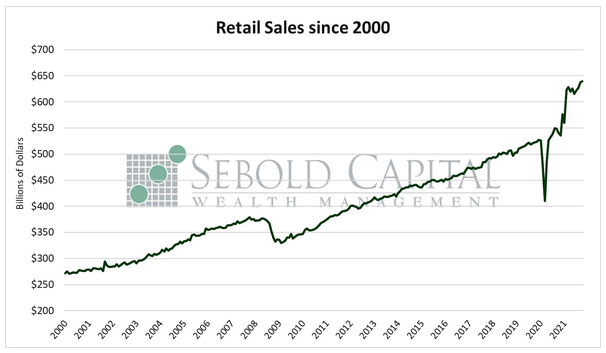

Retail Sales are the total amount of merchandise and related services sold to consumers. It is considered a sign of strength …

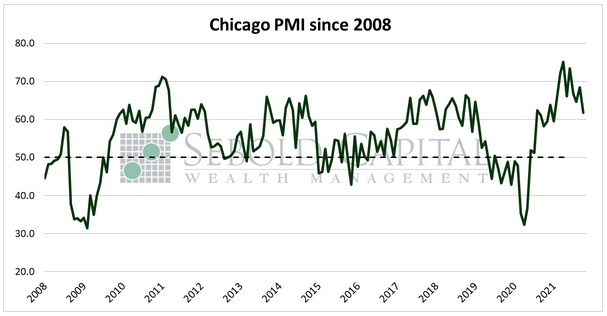

Chicago PMI

Chicago PMI is a composite index of business conditions in the Chicago area. Data from Chicagoland firms is collected by …

Personal Consumption Expenditures

Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure …

Retail Sales

Retail Sales are the total amount of merchandise and related services sold to consumers. It is considered a sign of strength …

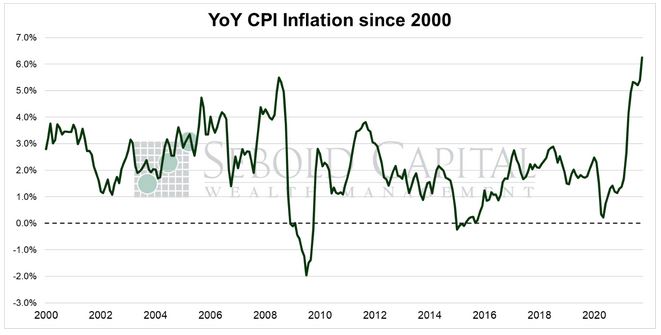

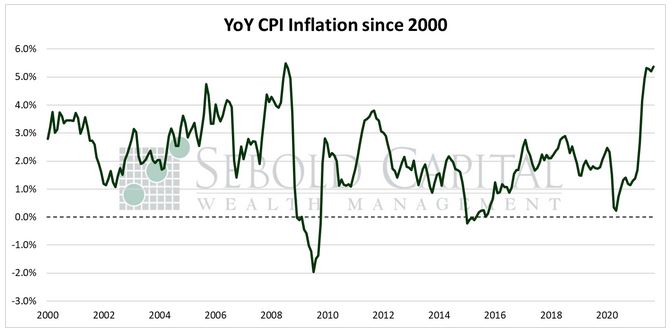

Consumer Price Index

The Consumer Price Index (CPI) shows us inflationary pressures in the economy. The CPI measures the average price levels of …

Consumer Price Index

The Consumer Price Index (CPI) shows us inflationary pressures in the economy. The CPI measures the average price levels of …

Consumer Spending

Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure …