The Employment Situation is a report by the Bureau of Labor Statistics that gives an overview of the overall employment …

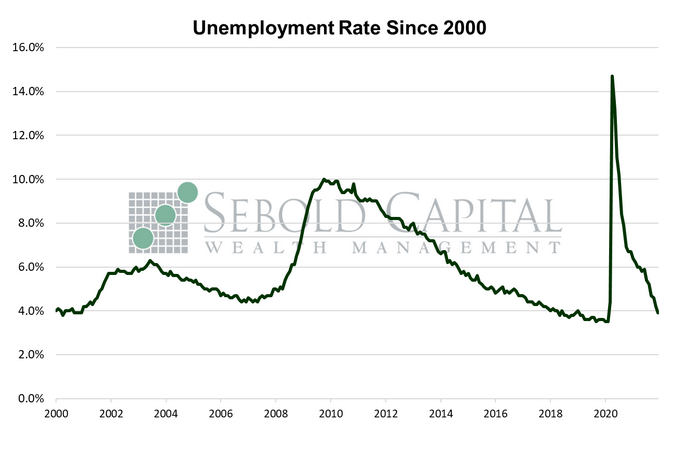

Employment Situation

The Employment Situation is a report by the Bureau of Labor Statistics that gives an overview of the overall employment …

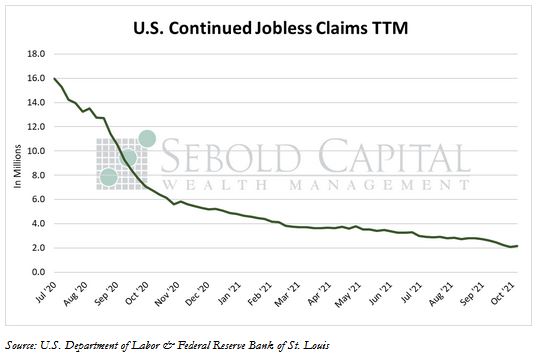

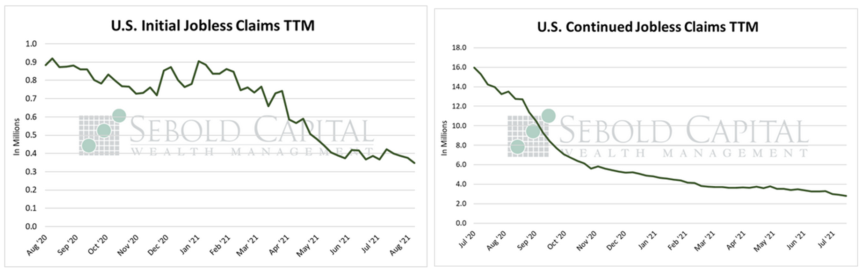

US Initial Jobless Claims

US Initial Jobless Claims, provided by the US Department of Labor, provides underlying data on how many new people have …

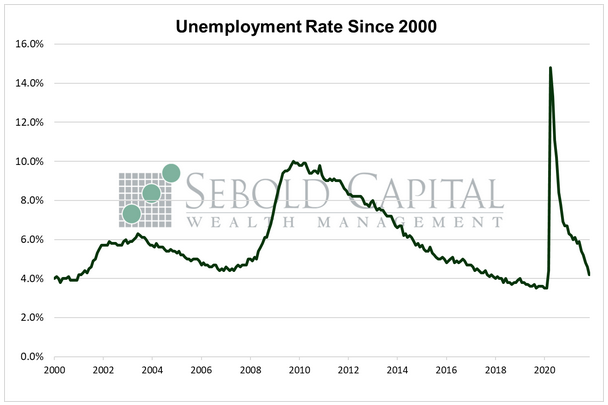

Employment Situation

The Employment Situation is a report by the Bureau of Labor Statistics that gives an overview of the overall employment …

Initial Jobless Claims

US Initial Jobless Claims, provided by the US Department of Labor, provides underlying data on how many new people have …

Producer Price Index

The Producer Price Index (PPI) looks at the average change in selling prices from the viewpoint of domestic producers of …

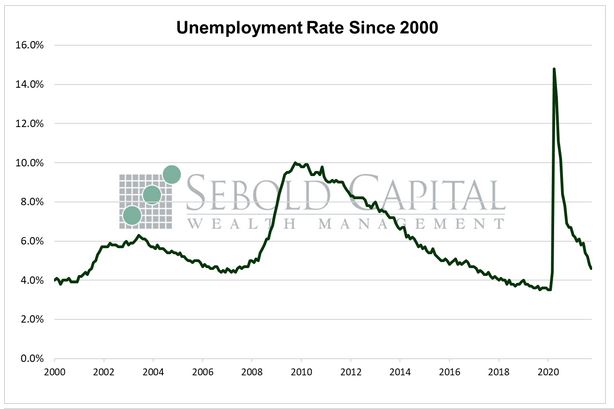

Employment Situation

The Employment Situation is a report by the Bureau of Labor Statistics that gives an overview of the overall employment …

Jobless Claims

US Initial Jobless Claims, provided by the US Department of Labor, provides underlying data on how many new people have …

Gross Domestic Product

Gross Domestic Product (GDP) is the broadest measure of economic activity within a country and measures the market value of …