Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure …

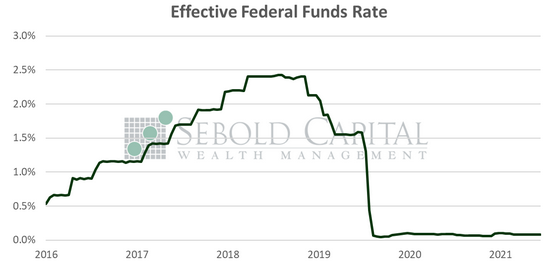

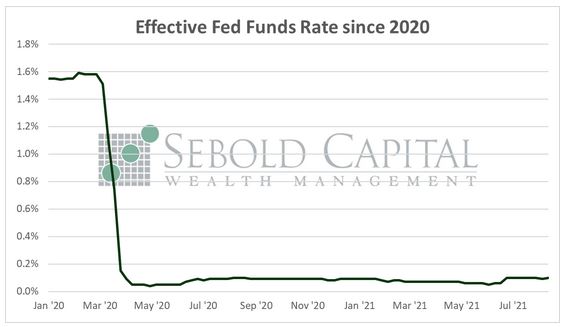

Fed Interest Rate Decision

As expected, the Federal Reserve announced today its first interest rate hike since 2018—25 basis points. This was not a …

Federal Funds

On December 15, the Federal Reserve made one of the most consequential announcements of the year regarding monetary policy. Not …

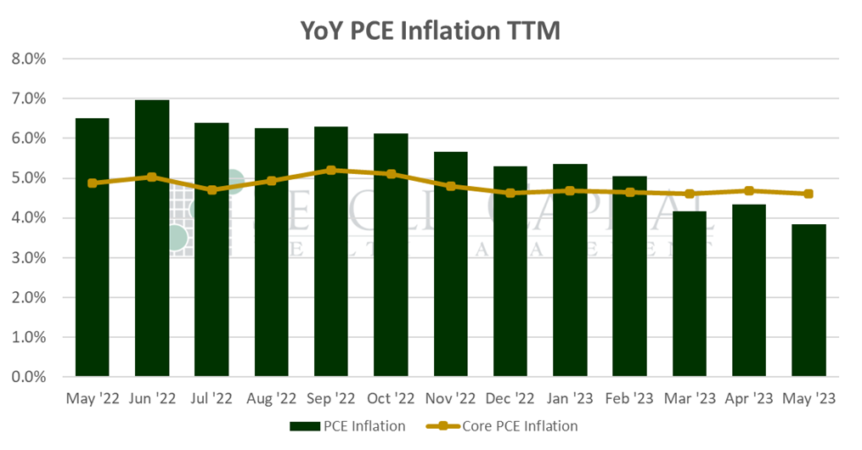

Personal Consumption Expenditures

Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure …

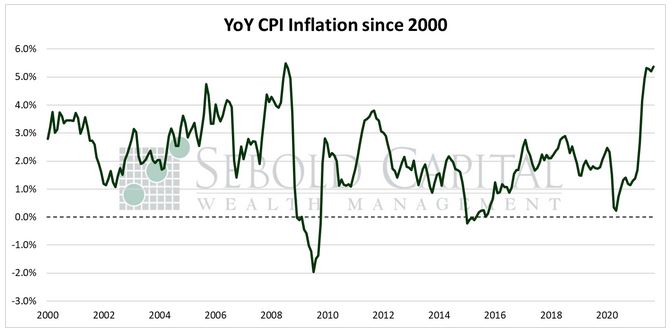

Consumer Price Index

The Consumer Price Index (CPI) shows us inflationary pressures in the economy. The CPI measures the average price levels of …

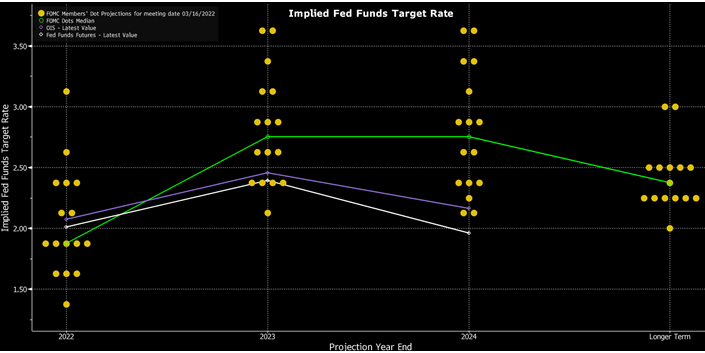

Federal Open Market Committee

Last Wednesday, the minutes of the last Federal Open Market Committee (FOMC), held in late July, were released. After a …

Producer Price Index

The Producer Price Index (PPI) looks at the average change in selling prices from the viewpoint of domestic producers of …

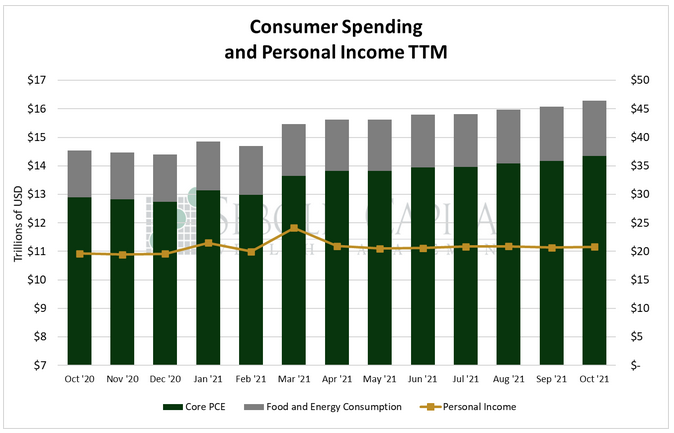

Consumer Spending

Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure …

New York Fed Manufacturing Index

The New York Fed Manufacturing Index, also known as the Empire State Manufacturing Index, measures business conditions in the manufacturing …

Producer Price Index

The Producer Price Index (PPI) looks at the average change in selling prices from the viewpoint of domestic producers of …

- Page 1 of 2

- 1

- 2