Last Wednesday, the minutes of the last Federal Open Market Committee (FOMC), held in late July, were released. After a …

Producer Price Index

The Producer Price Index (PPI) looks at the average change in selling prices from the viewpoint of domestic producers of …

Personal Consumption Expenditures

Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure …

Retail Sales

Retail Sales are the total amount of merchandise and related services sold to consumers. It is considered a sign of strength …

Interest Payments

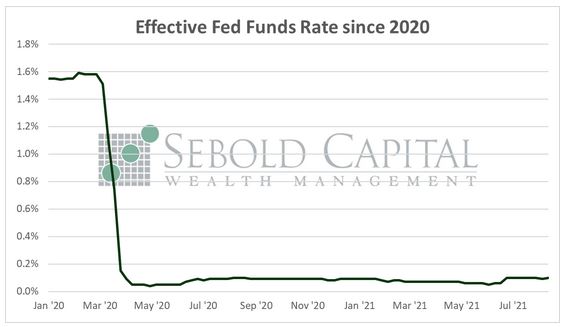

Last March, as the Coronavirus crisis was first beginning to unfold, the Federal Reserve slashed interest rates to record-low levels. …

Retail Sales

Retail Sales are the total amount of merchandise and related services sold to consumers. It is considered a sign of strength …

Personal Consumption Expenditures

Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure …

Import and Export Price Indexes

The import and export price indexes measure changes in the prices of goods and services coming in and out of …

Retail Sales

Retail Sales are the total amount of merchandise and related services sold to consumers. It is considered a sign of strength …

Consumer Sentiment

The US Index of Consumer Sentiment (ICS), as provided by the University of Michigan, tracks consumer sentiment in the US, …

- Page 1 of 2

- 1

- 2