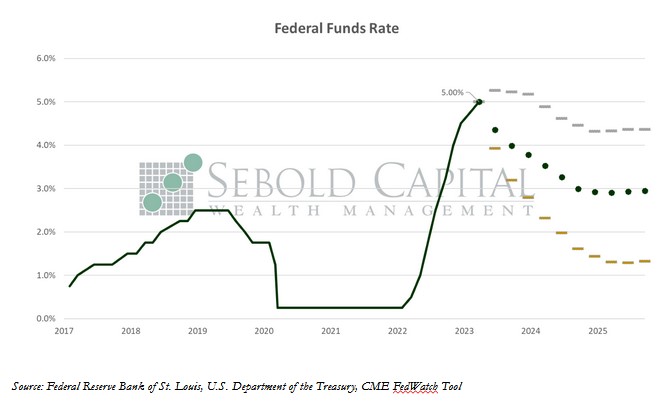

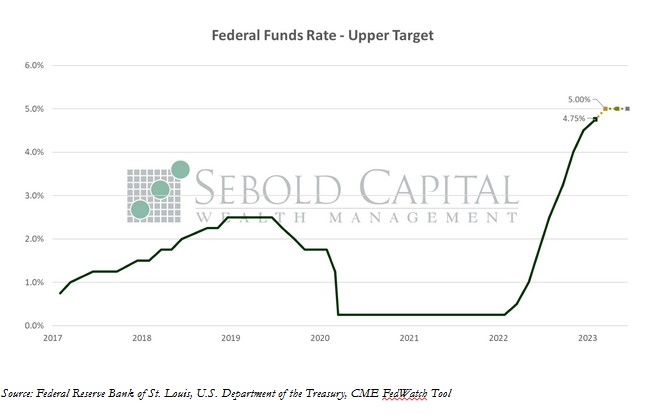

At its most recent policy meeting, the FOMC delivered its second interest rate hike for the year and the ninth …

Fed Interest Rate Decision

As expected, the FOMC delivered its first interest rate hike for the year at its latest meeting. After several rounds …

Fed Interest Rate Decision

In a widely anticipated move, the FOMC announced on Wednesday that it was hiking interest rates by 50 basis points—the …

Fed Interest Rate Decision

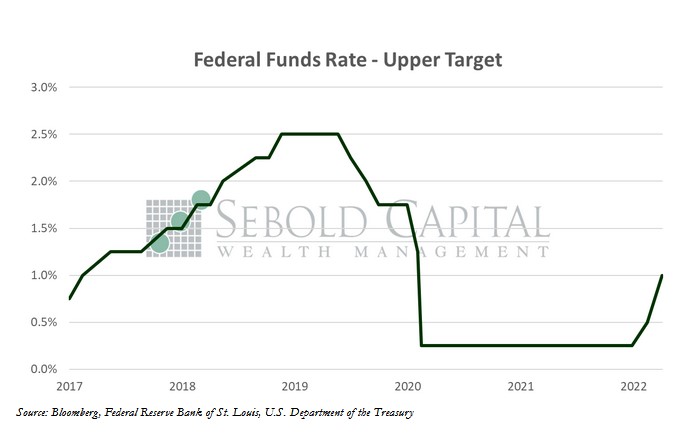

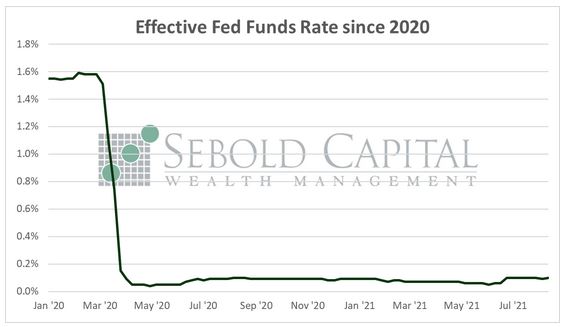

As expected, the Federal Reserve announced today its first interest rate hike since 2018—25 basis points. This was not a …

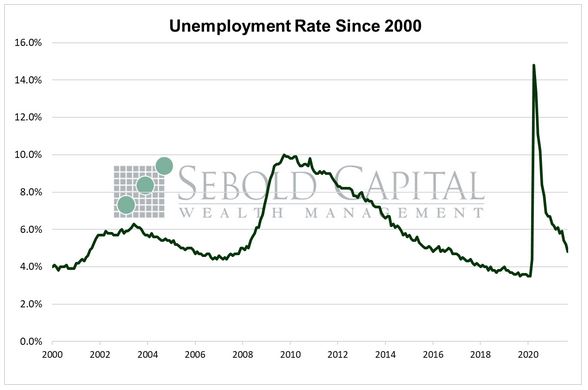

Employment Situation

The Employment Situation is a report by the Bureau of Labor Statistics that gives an overview of the overall employment …

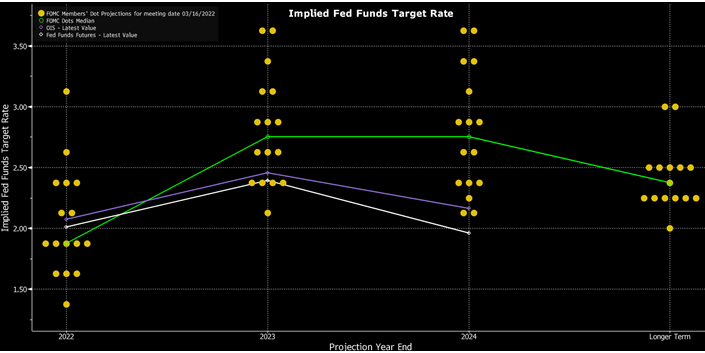

Federal Open Market Committee

Last Wednesday, the minutes of the last Federal Open Market Committee (FOMC), held in late July, were released. After a …

10-Year Treasury Rate

The 10-Year Treasury Rate is the yield received for investing in a US government-issued bond that has a maturity of …